Digitalisation will continue to grow and increasingly affect food retailing processes, as well as the entire added value chain. However, this does not mean delivery services will completely supersede physical food retailing. Thanks to the very good supply chain and the attraction of the “buying experience”, physical retailing will continue to have its place. After all, retail outlets are easily accessible for the vast majority of the population. When adapting to changing consumer habits and opportunities, which are opening up digitalisation, it must be expected that there will be a restructuring process based on new criteria.

Digitalisation is a holistic approach to retail thinking, management, and processes. Existing interfaces or demarcations between process stages can now be redefined. Complex processes can be simplified and accelerated.

Digitalisation is therefore an approach, which allows established ideas and fixed processes to be questioned, and which enables new business models to be developed. This requires the quality of the service, products, and packaging to be consistently high and reliable. The DLG therefore offers certification in e-commerce.

Data will be the new currency. Whoever has possession of data, particularly about customers and products, can create competitive advantages for himself through differentiation and additional services. The sensitive and correct handling of data becomes a significant element in building trust - as well as creating differentiation.

The greatest challenge lies in winning the trust of those involved and enjoying it over the long term. This applies to all customer, product, and process data. Data security is therefore not only a legal and technical challenge, it is also a communicative challenge.

Data allows algorithms to be produced, which make it possible to optimise processes and services. This enables the process of guiding customers in an online shop to be continuously improved: What is the customer looking at, what did the customer buy previously, or what type of consumer is he or she? All this is evaluated and incorporated into the range of products and services on offer - true to the motto “You may also need that”. Why should this technology not also find its way into real shops? It could be preparing the shopping list at home, or calculating the best route through the supermarket via a display on the shopping trolley, which scans my shopping list and gives me suggestions about other products that I could or should purchase. Smart technology will enable stocks of product in my refrigerator or store cupboard to be digitally recorded, before a shopping list is generated based on my preferences, e.g. low-priced, local, or organic products.

Data evaluation enables trends to be detected, allowing measures to be taken to react quickly. If one systematically thinks through the answer to the above question, then it becomes possible to envisage the individualisation of products and the buying process. Why, for example, is it not possible to trigger a purchase order with a supplier, if the stock of a product is running low at home?

Digitalisation in the area of logistics includes not only the efficient organisation of supply processes, but also aspects such as transportation, robotics, and automation within the company. Intensive digitalisation processes within the added value chain also take place, for example, in areas such as predictive maintenance.

In my opinion, we have already reached a high level in determining a particular demand, but these evaluation systems will undoubtedly be developed still further. The possibilities with digitalisation add an additional instrument, which enables new and innovative systems to be introduced.

Here I can only repeat what I said earlier - whoever has possession of data has power. If the food retailers are able to better capture the needs of their customers, then this will of course flow into the range of products on offer, and retailers will demand from their suppliers that they produce and deliver more customised products.

There is certainly potential in this area, as well. If demand can be determined more accurately, if portion sizes can be adjusted more individually, or if restocking can be evaluated automatically, there will be less quantity required and therefore less food wastage and less packaging.

Traceability is a major topic and will continue to remain so. Manufacturing and logistics processes, which can be traced quickly, increase the level of safety and provide the transparency that consumers demand.

I see the main factors for success as supply flexibility, reliable and punctual deliveries, product quality and diversity, as well of course as low prices.

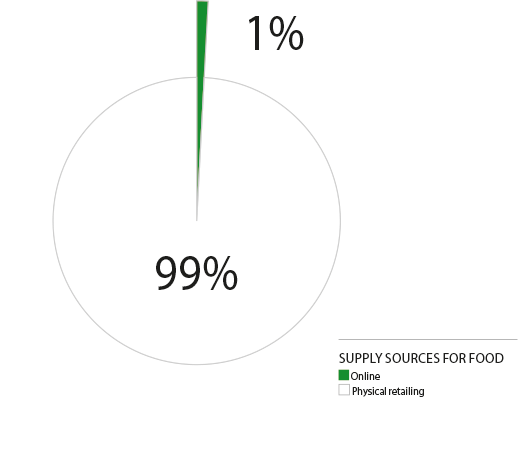

According to the current GfK figures, only one fifth of German consumers have ever ordered food online, but two thirds have already bought media products, electronics, or clothing. In the case of food, it is primarily heavy or bulky products and those with a long shelf life, such as preserves, drinks, or sweets, which open up entry into online shopping for predominantly younger customers. However, the product range is being gradually expanded, as the logistics become more sophisticated. Fresh products such as fish or meat are likely to remain a major challenge. The effort involved will probably be too great for both customers and suppliers, which means this business will be unprofitable.

The crucial factor is the “last mile” in the delivery. Whoever can solve this problem is a major step forward. Other strategic factors are the issues of order picking and stocking special product ranges.

The nationwide supply coverage in physical food retailing is very good, and customers want to see and - wherever possible - select the products themselves. And delivery costs, particularly for the “last mile” are relatively high.

I am sure there will be new innovative solutions for these logistical issues so the “last mile”, which has been relatively expensive up to now, can become more cost-effective. Autonomous delivery services, collection centers, refrigerators as “postboxes”, time limits on deliveries, and many others right up to the use of drones. There are many ideas, of which these are just the start.

The market for online food will undoubtedly grow, if only because consumers are becoming increasingly used to ordering goods via the Internet. The desire for greater flexibility is also increasing. In my view, we are just at the start of this process since the demand is already there. Also just think about very rural areas or the increase in flexible working hours.

I would imagine physical retailing will increasingly focus on the shopping experience. This will also include “flagship stores” where products can more easily be viewed and selected, and where in the case of food products they can be consumed on site.

We have recently shone some light on the problem of changes in packaging at a DLG event on the subject of e-commerce. With e-commerce there are completely different requirements of the packaging. Conventionally it is usually the case, that packaging is used to catch the attention of the customer and act as a medium for important and legally prescribed information. In e-commerce on the other hand, this is very different - the primary aim of the pack is to protect the product, and it should ideally take up as little space as possible in waste disposal bins. There is still much development work to be done on this subject.

I think this question can be put somewhat differently. Customers will expect food products to be supplied to the standards and in the way that they wish, just as consumers already know from other products. The fact that this may cost more will certainly be reflected in the price of the product. But this process will also of course be subject to intensive price competition between suppliers - and ultimately it will be the consumer who decides.

The DLG was founded in 1885 and is considered today as the leading organisation for the agricultural and food industries with more than 29,000 members. It is a non-commercial organisation, which is politically independent. With its open and international network, the DLG develops solutions with experts from around the world to meet the challenges of the future. It organises internationally leading trade fairs and events in the sectors of crop production, animal husbandry, agricultural and forestry science, energy supply, and food technology. Its quality inspections conducted on food products, agricultural science, and equipment are internationally recognized as world leaders. Thanks to its technical expertise and network of experts, the DLG continues to give new impetus to practical ideas.

07.04.2019